Like all other taxable income, the IRS requires you to report prizes and winnings on your tax return, too. That means you might have to pay taxes on those winnings. Your winnings end up being included in your taxable income, which is used to calculate the tax you owe. But before you report your prize and gambling income, you need to know what does and doesn't count as income.

- Typically, tax on winnings, like sweepstakes or prize money, should be reported to you in Box 3 (other income) of IRS Form 1099-MISC. This includes winnings from sweepstakes when you did not make an effort to enter and also applies to merchandise won from a game show. Taxes on Lottery Winnings, Raffles, Charity Drawings, and Sweepstakes by Wager.

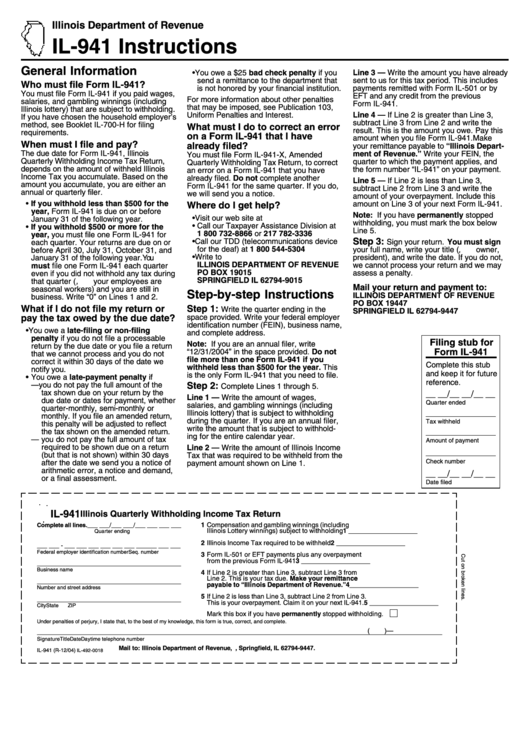

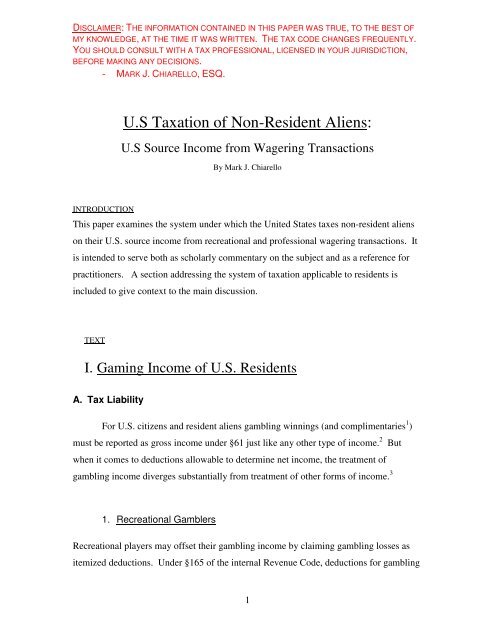

- In order to recover gambling taxes withheld, Canadian residents will have to file form 1040NR, U.S. Non-resident Alien Income Tax Return under provisions of the aforementioned United States-Canada income tax treaty. Gambling winnings taxation laws are significantly different between Canada and the U.S.

- If your winnings are reported on a Form W-2G, federal taxes are withheld at a flat rate of 24%. If you didn’t give the payer your tax ID number, the withholding rate is also 24%. Withholding is required when the winnings, minus the bet, are: More than $5,000 from sweepstakes, wagering pools, lotteries.

- Generally, yes, but it depends on the state. Every state has its own rules regarding nonresident returns. For example, nonresidents with more than $33 in Pennsylvania-sourced income must file a return, while nonresidents with less than $600 in Missouri income don't have to file.

The US uses a flat 25% tax rate on all gambling winnings. Taxes are applied to all gambling, including sweepstakes and other prizes. When you hit a taxable win in a physical casino, you’ll get a.

Don't worry about knowing tax rules, with TurboTax Live, you can connect with Tax Experts online for unlimited tax advice and a line-by-line review, backed by a 100% accurate expert approved guarantee.

Gambling and lottery winnings and losses

Whether you play the lottery, slots, blackjack, roulette or another game considered gambling, you must report all of your winnings even if you end up losing money overall.

Popular Searches

The IRS states that you're supposed to keep a diary or similar record that details your winnings and losses, which includes information such as:

- The dates and types of specific wagers.

- The amount you won or lost.

- The address of the gambling establishment.

- The names of other people present with you at the gambling establishment.

You should also keep other documentation that demonstrates your gambling activities such as,

- bank withdrawals,

- losing lottery tickets or

- payment slips from the gambling establishment.

Depending on the size of your win, you may receive a Form W-2G, Certain Gambling Winnings and may have federal income taxes withheld from your prize by the gambling establishment.

Gambling winnings are unique because you can also deduct your gambling losses and certain other expenses, but only in specific circumstances (see our article about this).

- You don't report your gambling income net of expenses, though.

- Instead, you must report your gambling income and gambling expenses separately.

- Unfortunately, losses can only be deducted if you itemize your deductions.

You don't need to worry about which forms you need to fill out, though. TurboTax will ask you simple questions to get the necessary information to fill out the forms on your behalf based on your answers.

Other types of winnings

Casinos and lotteries aren't the only ways you can win money or other prizes. If you've received any kind of income from the following sources, you'll have to report it to the IRS, as well.

- Cash prizes: If you enter a drawing and win $1,000, you've won a cash prize. Other ways to win cash prizes could include sweepstakes, a game show or reality TV competition. You'll need to include all prizes as income on your tax return, even if they're as small as a dollar.

- Noncash prizes: The IRS considers noncash prizes as income you should report as well. Whether you win a $25 gift card to your favorite restaurant from a radio contest, a new TV, a year's supply of a particular product, a luxury vacation for two to Europe or a brand-new car from a game show, you're required to report the fair market value of these prizes as other income on your tax return.

- Fantasy sports and pooled winnings:Fantasy sports and pooled winnings with friends, coworkers or anyone else also need to be reported. Your friends won't issue you a Form 1099-MISC, or Form W-2G, but that doesn't mean the income shouldn't be reported.

- Gifts: Gifts aren't considered a form of winnings in the IRS's eyes even if they're a windfall for your situation. In the vast majority of cases, the donor is responsible for paying any gift tax required. However, it is possible for the person receiving the gift to agree to pay the tax instead.

- Inheritance: When you receive an inheritance, you generally aren't obligated to pay any taxes on it on the federal income tax level. That said, the estate of the deceased person may have to pay an estate tax before passing on your inheritance to you.

TurboTax Premier searches for more than 400 tax deductions, to make sure you get every credit and deduction you qualify for. Automatically import thousands of transactions from your financial institutions to get started.

Frequently Asked Questions

Whether you've already won the grand prize or think this is going to be your lucky year, it pays to have your questions answered before it comes time to file. Here are some of the most popular questions and what you need to know.

Is your tax bracket affected by what you win?

Your winnings are part of your taxable income, which determines what marginal tax bracket you fall into. Only the additional income in the higher tax brackets will be taxed at the higher rates. Any income that falls in the lower tax brackets will be taxed at the lower rates.

Are the tax rules different if you receive a lump-sum payout vs. a payout in pieces over time?

The rules regarding tax on winnings are the same whether the prize is issued in a lump-sum payout or in pieces over time. You report the income when you receive it. That said, the tax impacts can be different based on the year you receive the income because the amount of tax you pay is based on your total taxable income each year.

- If you receive a large payout in a single payment, that payout could push you into higher marginal income tax brackets.

- If you spread it out over multiple years, you may end up staying in lower tax brackets.

What if I didn't receive a Form 1099-MISC or a Form W-2G?

It doesn't matter if you receive a 1099-MISC or a W-2G reporting your winnings or not. You'll still need to report all income to the IRS. You just have to add your unreported winnings amounts to the applicable lines on your tax return.

Us Tax Return For Gambling Winnings Money

Thankfully, you don't need to know where to place each item of unreported income on your tax return. TurboTax can help by asking simple questions to make sure you're reporting all of your income and winnings that need to be reported.

Us Tax Return For Gambling Winnings Real Money

How can you prepare yourself and your finances after you win but before you file your tax return?

After you win money, you should take steps to prepare for the potential tax impact. Ideally, you should set aside a portion of those winnings to cover the taxes you'll owe, so you have the money when it's time to pay your taxes.

Us Tax Return For Gambling Winnings 2019

Keep in mind, you can't wait to pay taxes until the tax deadline if it's over a certain amount. See the section 'Do I need to pay estimated taxes' in our article 'Estimated Taxes: How to Determine What to Pay and When' to determine if you meet these thresholds.

- You'll have to run the numbers, especially if you win a large amount of money, to see which marginal income tax bracket the winnings will fall in. Then you can estimate how much you'll potentially owe.

- TurboTax's TaxCaster can help you estimate your taxes.

- Depending on the size of the prize, you may want to make a quarterly estimated tax payment as well.

Your taxes have many moving parts that could result in a higher or lower amount owed than your estimate if things don't go exactly as you plan. If you set aside too much money, you can always reclaim the money later, but if you don't set aside enough, you may find yourself owing a big tax bill come tax time.

Remember, with TurboTax, we'll ask you simple questions and fill out the right tax forms based on your answers to maximize your tax deductions.

This article was originally published by TheStreet.